[Translation of the title: Wheat trade and wheat prices in France, 1825-1913.]

by Sylvie Drame, Christian Gonfalone, Judith A. Miller, and Bertrand Roehner

Summary

Summary

Until the middle of the nineteenth century, fluctuations in grain prices exerted a determining influence over the rest of the economy. The transition from an agricultural economy, in which periods of contraction were marked by price rises, to the modern industrial economy, in which periods of recession are on the contrary characterized by deflation only came about in the second half of this pivotal century.

The statistics published in this book constitute a collection of grain prices that is probably unique in Europe in terms of its coverage of both time and space: prices are given every two weeks for a set of about fifty market places covering all the regions of France. These data will permit the testing of economic theories concerning price formation, market integration and the diffusion of price fluctuations.

Although basically written in French the contains a six-page English summary; furthermore the captions of the numerous figures and of the tables which constitute the bulk of the book are both in English and in French.

by Anne Paquette and Bertrand Roehner

Summary

Summary

The book is intended for researchers using English as a second language. It provides useful guidelines for writing a scientific paper, presenting a talk, or composing a CV. The chapters are organized into more than thirty language functionalities such as: abstracts, acknowledgments, approximation, clarification, comparison, illustration, objections, etc. By checking a number of faulty or awkward formulations listed at the end of the book the reader is able to test his (her) abilities.

The book has been translated into Spanish under the title: Science in English. El ingles de los textos cientificos. Larousse (1996, 302 pages).

by Bertrand M. Roehner

Summary

Summary

The purpose of the book is to investigate the foundations of international and interregional trade at the microeconomic level of spatially separated markets. At this level, price arbitrage and local disparities in production and demand functions are the main determinants. The model is developed step by step: first it is introduced in the perspective of spatial price equilibrium, then its dynamic extension is applied to non-equilibrium situations. Finally, for the sake of analytical simplicity, the model is is formulated in the framework of partial differential equations for random fields. The theoretical construction goes hand in hand with empirical investigation and the model is confronted against statistical evidence whenever it is possible.

by Bertrand M. Roehner

Summary

Summary

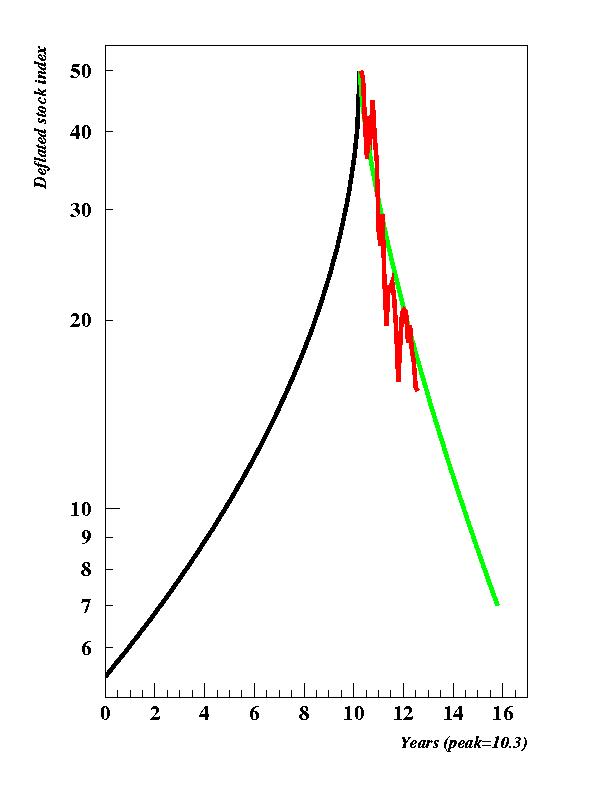

Besides analyzing stock markets, the book considers a wide range of speculative markets for various items such as real estate, commodities, postage-stamps, antiquarian books. In particular, it highlights the following regularities: (i) During a speculative episode the price of expensive items increases more than the price of less expensive ones. This is referred to as the price multiplier effect. (ii) Price peaks for stocks and most commodities on average follow a well-defined pattern that we call the sharp peak - flat trough pattern which is characterized by an overall symmetry between the ascending and descending phase. That observation has definite implications for stock market price peaks. (iii) The stocks whose prices experience the strongest increase during a bull market, better resist during the subsequent bear market, an effect referred to as the resilience pattern. Such regularities pave the way for a mathematical theory of speculation. Being mainly empirical the book is easy to read and does not require technical prerequisites in finance, economics or mathematics.

Published in mid-January 2001, the book contains a prediction for

the course of the NASDAQ composite index over the period 2000-2006

(graph 7.12 on page 176)

which (so far) has turned out to be fairly accurate.

Published in mid-January 2001, the book contains a prediction for

the course of the NASDAQ composite index over the period 2000-2006

(graph 7.12 on page 176)

which (so far) has turned out to be fairly accurate.

edited by Jean-Philippe Bouchaud, Matteo Marsili, Bertrand M. Roehner, and Frantisek Slanina

Summary

The book contains the papers of 10 keynote lectures, 18 contributed lectures and 11 posters. The names and addresses of the fifty participants are listed at the end of the volume. These proceedings were published as a special issue of the journal Physica A, 299, 1-2 (1 October 2001).

Summary

Summary

The book studies the collective behavior of economic agents during speculative episodes. Such moments are marked by a special atmosphere of optimism and confidence in the future which permeates not only the financial market but society as a whole. Exuberance, ebullience, and bullish are some of the expressions that describe the up-going phase whereas the down-going phase is associated with words such as uncertainty, fear, contraction, or bearish.

Much as Newton's discovery of universal gravitation could not have derived solely from observing falling apples (despite anecdotal evidence to the contrary), for speculative bubbles one also has to study various episodes from a comparative perspective in order to be able to discover major regularities. The analysis developed in this book follows a few simple but unconventional ideas. Investors are assumed to exhibit the same basic behavior during a speculative episode whether they trade stocks, real estate, or postage stamps. This idea is crucial for setting up a comparative analysis. The main objective of the book is to show that behind the bewildering diversity of historical episodes it is possible to find hidden regularities, thus preparing the way for a unified theory of speculation. A theoretical framework is presented in the final chapters, which show how some basic concepts of dynamical system theory play an instrumental role in providing a unified description of several effects to be observed in various speculative episodes.

Much of the text is written at a level that does not require a background in the technical aspects of economics, finance or mathematics. It will therefore serve as a useful primer for undergraduate and graduate students of econophysics, and indeed for any reader with an interest in economics as seen from the perspective of physics.

REVIEWS OF "PATTERNS OF SPECULATION" [excerpts]

Econophysics is an interesting new development that has been clearly explained and expertly employed by Bertrand Roehner, who is to be congratulated on his pioneering contribution. This has shaped the structure and tone of a book that is highly systematic and precise, in a word scientific. For the first time in a century deductive economics is under concerted and effective attack by empiricists from within and without the old empire. No doubt it will go the way of all seemingly impregnable empires of the past.

Graeme Snooks, Australian National University

by Bertrand M. Roehner and Tony Syme.

This book provides an introduction to what we have called

analytical history, a way of doing comparative history that

focuses on a large number of small events, rather than

(as done traditionally) on a small

number of large events. This approach

was put to work in several other studies such as "Patterns of speculation"

or "Separatism and integration".

This book provides an introduction to what we have called

analytical history, a way of doing comparative history that

focuses on a large number of small events, rather than

(as done traditionally) on a small

number of large events. This approach

was put to work in several other studies such as "Patterns of speculation"

or "Separatism and integration".

Summary

Historical landmarks, such as wars, coups, and revolutions, seem to arise under unique conditions. Indeed, what seems to distinguish history from the natural and social sciences is its inability to be dissected or generalized in any meaningful way. Yet, even complex and large-scale events like the American and French Revolutions can be broken down into their component parts, and as Bertrand Roehner and Tony Syme show these smaller modules are rarely unique to these particular events.

The aim of the book is to analyze clusters of similar, elementary occurrences that serve as the building blocks of more global events. Making connections between seemingly unrelated case studies, Roehner and Syme apply scientific methodology to the analysis of history. Their book identifies the recurrent patterns of behavior that shape the histories of different countries separated by vast stretches of time and space. Taking advantage of a broad wealth of historical evidence, the authors decipher what may be seen as a kind of genetic code of history.

REVIEWS OF "PATTERN AND REPERTOIRE IN HISTORY" [excerpts]

I started to write that the authors bring a breath of fresh air into historiography, then realized that their arrival on the scene more closely resembles a tornado. Good ideas, analogies, and illustrations come swirling and densely packed leaving a lot of historical terrain littered with debris.Roehner and Syme concentrate on identifying dynamic similarities by means of valuable comparisons over wide ranges of time and space. Such an analysis exactly reverses the conventional balance. Epistemological skeptics and historians will all find something to disagree with. Yet those who travel with the authors are in for a thrilling ride. They raise great questions and go at them boldly.

Charles Tilly, Columbia University

Many social scientists these days are writing on one or another sort of comparative history. This marvelous book makes an impressively strong case for comparative history of a particular sort. Rather than go directly after big macrogeneralizations the authors propose looking for recurrent patterns in much smaller components. Generalizing about something as complex a the class of, say revolutions, may be foolhardily; looking for repetitive patterns in such components of revolutions as [for instance] how crowds occupy urban space may be far more fruitful. Comparativists often wrestle with how to sort out many variables in relation to few cases; decomposition opens the prospect of larger N's. The authors at a number of points warn that their sort of analytical history may put off many readers because it abandons the pleasure of story-telling. While no doubt some may be put off, there may be others, who like myself, will find the book quite enjoyable. The discovery of unexpected connection and pattern yields its own pleasure. I actually found this book a lot of fun. This is a superb book and I wish it the large audience among social scientists that it deserves.

John Markoff, University of Pittsburgh

by Bertrand M. Roehner, with the collaboration of Leonard J. Rahilly

Summary

Summary

Relying on a comparative perspective, this book fills a gap between political, sociological, and historical analysis of separatism. Instead of starting, as is traditional, from a preconceived conception of nationalism, Roehner's approach reverses the perspective. He shows that the forms taken by liberation struggles provide a fingerprint of the kind of nationalism at work. For instance, bloody and desperate uprisings taking place mainly in rural areas are typical of a nation which has been deprived of its land, as seen in 18th century Ireland or 19th century New Zealand; whereas protestation meetings taking place in cities reveal a revolt of the ruling class against political subordination as seen in Hungary in the 19th century, in Egypt or Morocco in the first half of the 20th century, or in Kosovo in the 1990s.

Moreover the socio-historical perspective adopted in this study permits to understand that religion and language are but two different facets of a nation's identity. In 17th century Europe, religion was the principal social cement, but in the course of the 19th century languages progressively took over the role formerly assumed by religions. Through its broad perspective, this book allows a new insight into the various ways separatism is likely to manifest itself in the world of the 21th century, and it provides a framework for understanding the diverse components of nationalism.

REVIEWS OF "SEPARATISM AND INTEGRATION" [excerpts]

[This] book is a brilliant tour de force. It could well become one of the classics (with Deutsch, Gellner, Kohn) in the field of nationalism. Overall the book is magnificent.

David Laitin, Stanford University